Welcome to No Bull’s first update from our new platform—same No Bull, new home.

In Today’s Update

As the year winds down and markets head into the holiday stretch, price action across grains, oilseeds, and energy is handing out fewer gifts and a few more lumps of coal—sending some clear, uncomfortable signals into year-end.

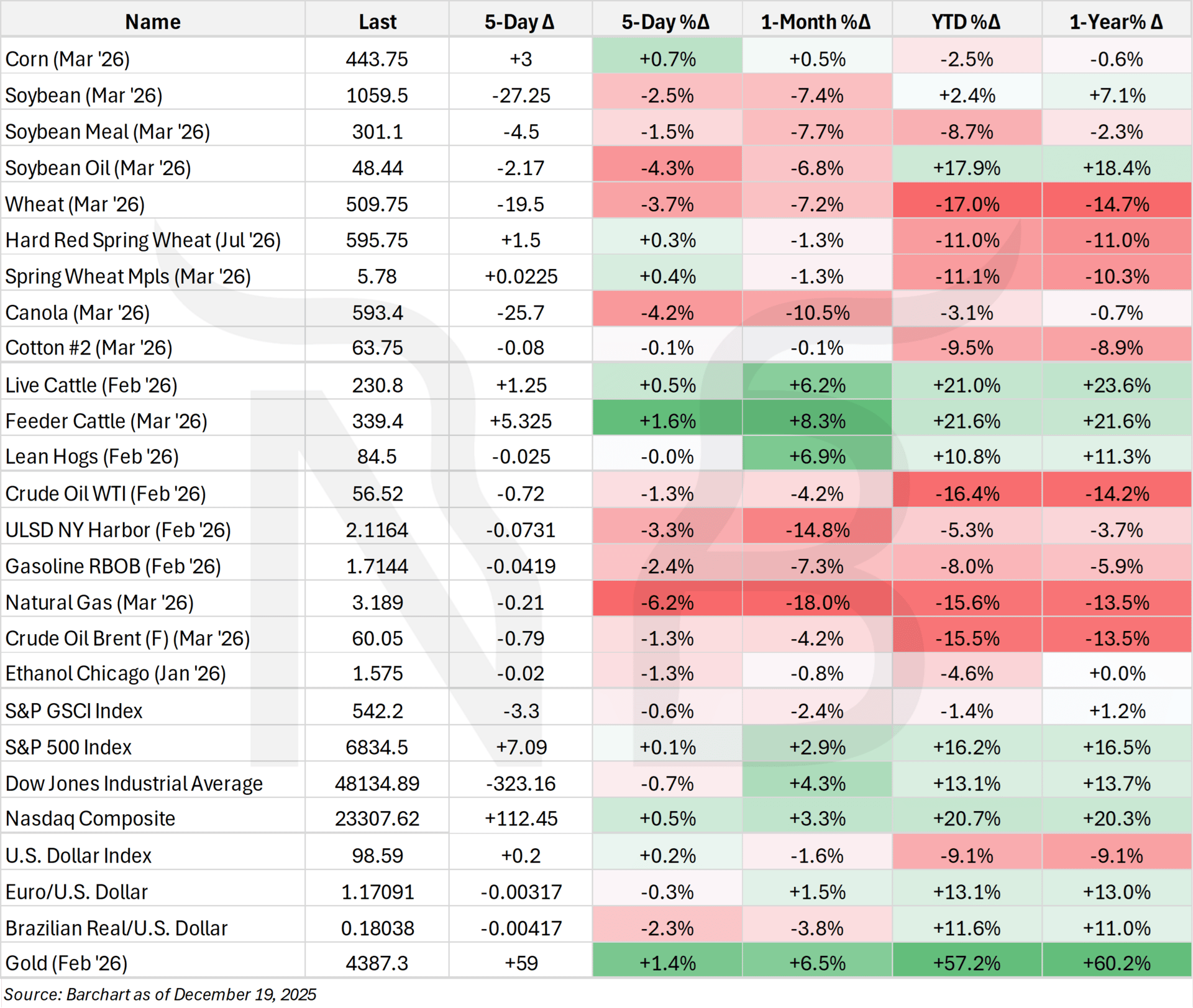

Weekly Winners & Losers

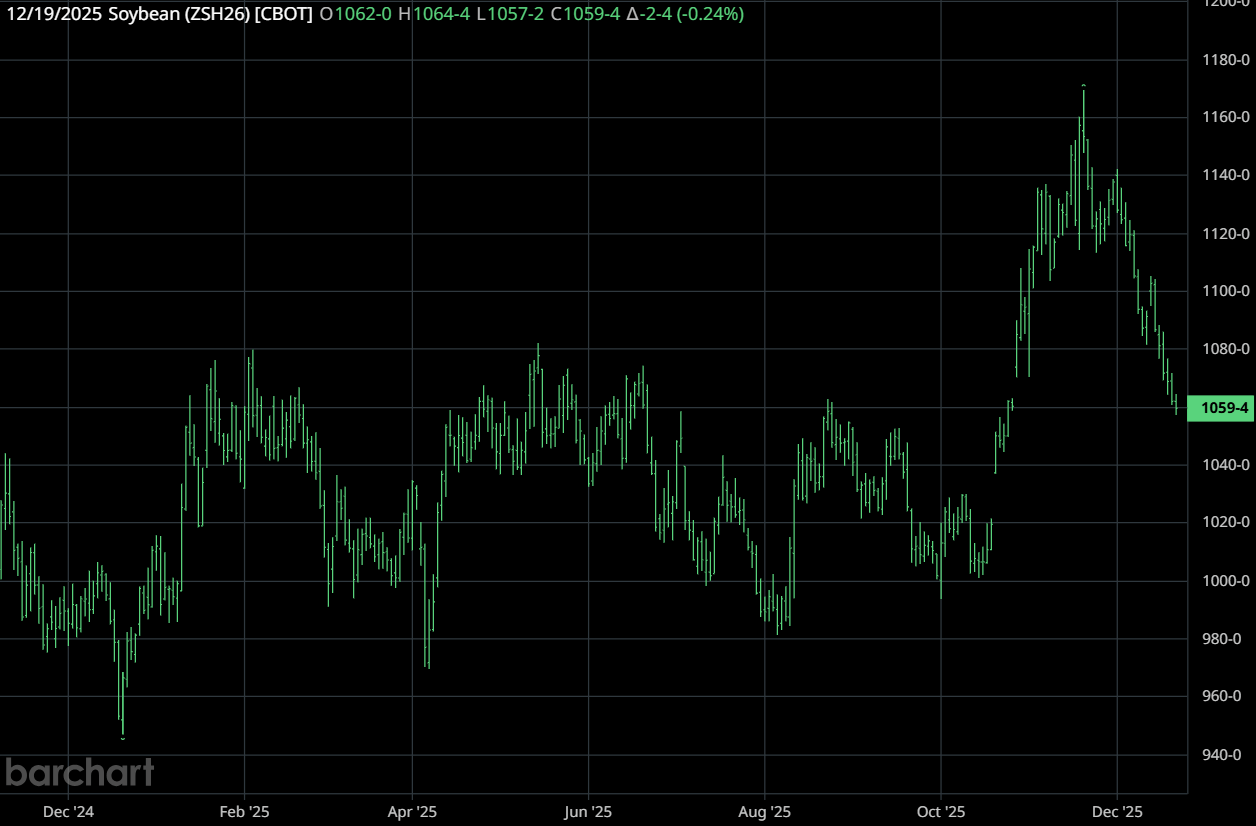

It was another rough week for soybeans, down 28 cents and marking the third consecutive weekly loss. The weakness comes despite continued Chinese buying, with additional cargos flashed to both China and unknown destinations. Sinograin remains active in the U.S. market, balancing purchases with auctions and reserve rotations. Even so, futures failed to respond, weighed down by favorable South American weather and a market increasingly focused on timing rather than total commitments.

The market has largely moved past questioning China’s 12 MMT commitment, which is now widely believed to be at least three-quarters covered. Instead, attention has shifted to what comes next — particularly with Brazil’s new crop just weeks away and its export program set to ramp up quickly.

Inspections remain well below last year’s pace, and even optimistic catch-up scenarios struggle to close the growing year-on-year gap. As a result, futures continue to reflect skepticism that current buying will translate into sustained support as Brazil’s export program accelerates.

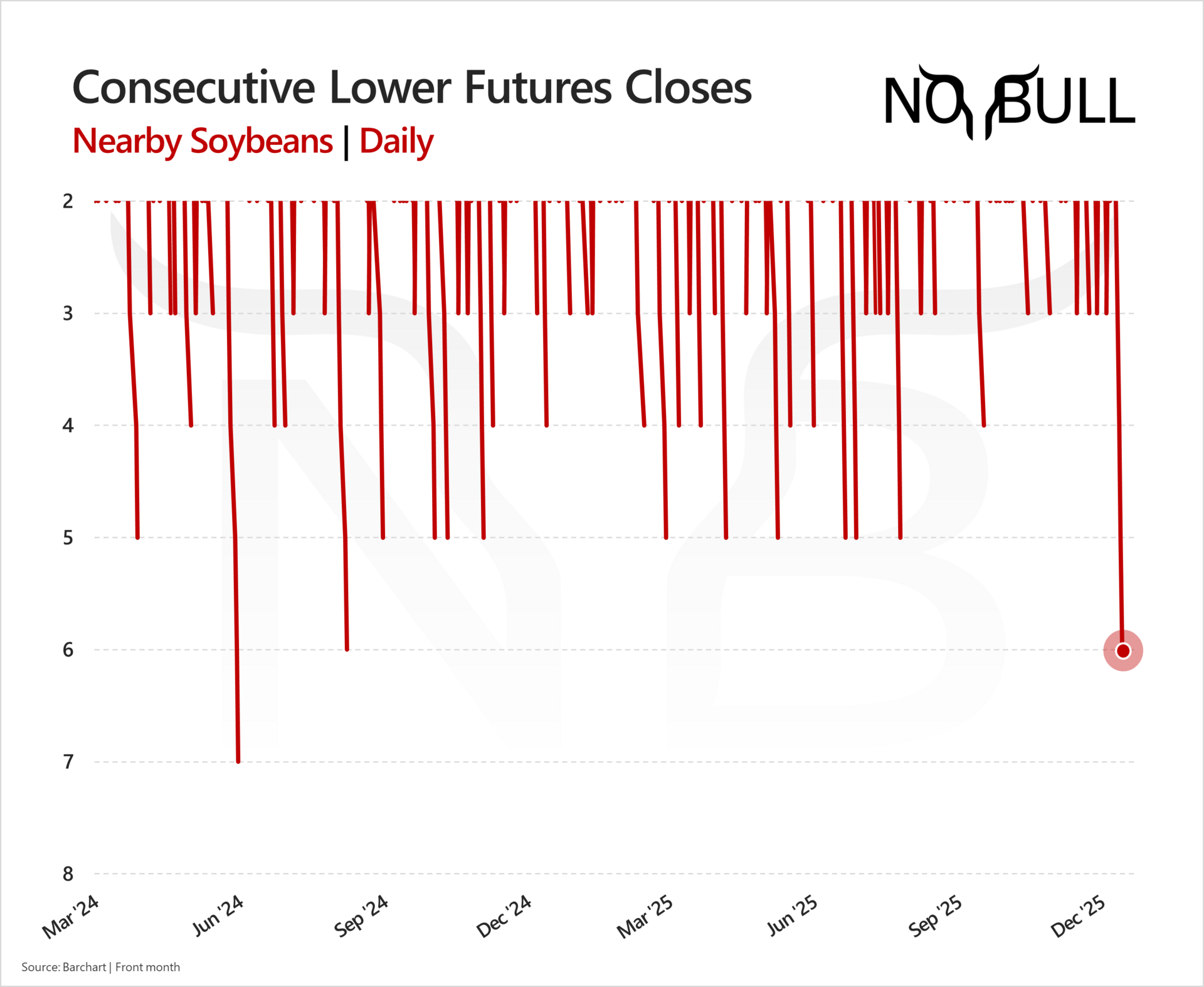

Adding to the pressure as the year winds down, soybeans extended losses for a sixth consecutive session, the longest losing streak since August 2024, pushing futures to new lows for the move.

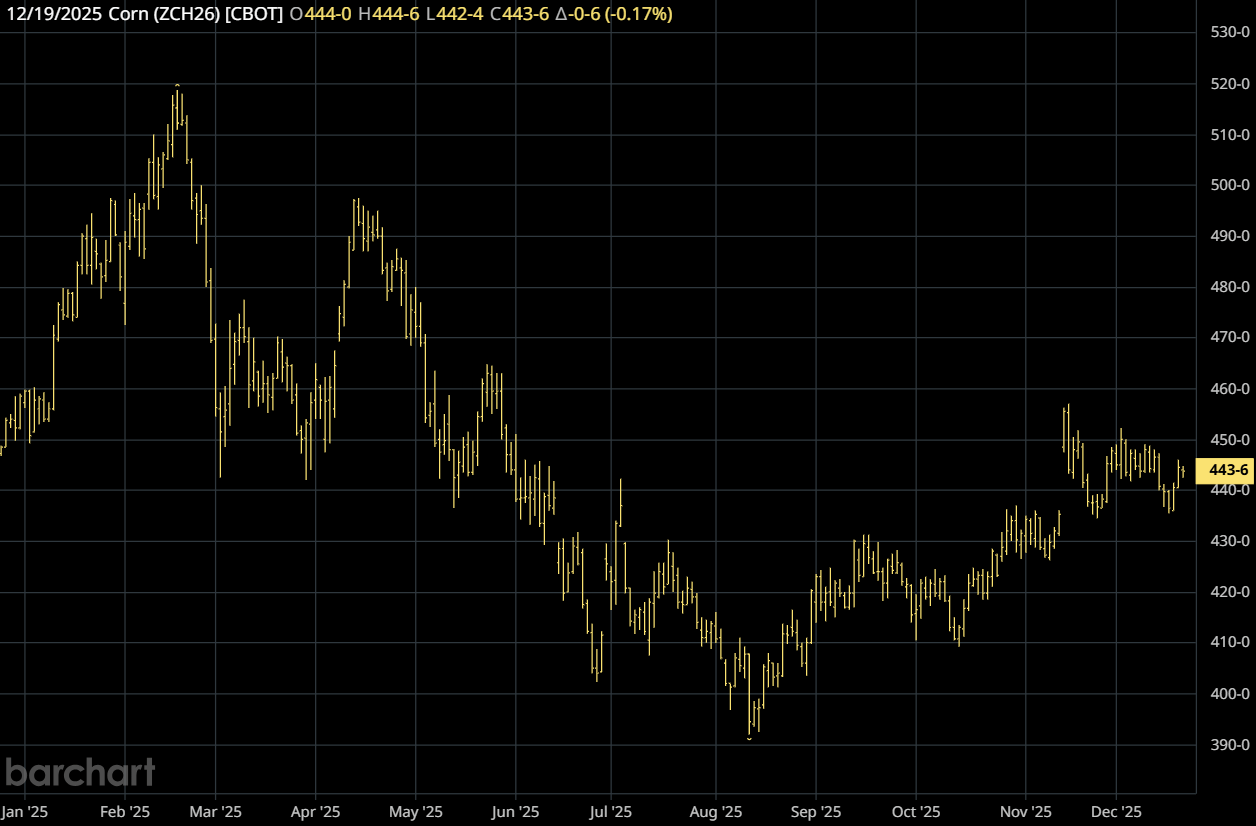

Corn, on the other hand, managed to eke out a 3-cent gain on the week, supported by continued strength in demand. Export sales and inspections both remain well ahead of last year’s pace, reinforcing the view that U.S. corn is still competitive in the near term.

That being said, the pace of new sales has begun to lag inspections, a dynamic that suggests current strength may be front-loaded and vulnerable as additional export competition—particularly as Ukraine gradually returns to the market.

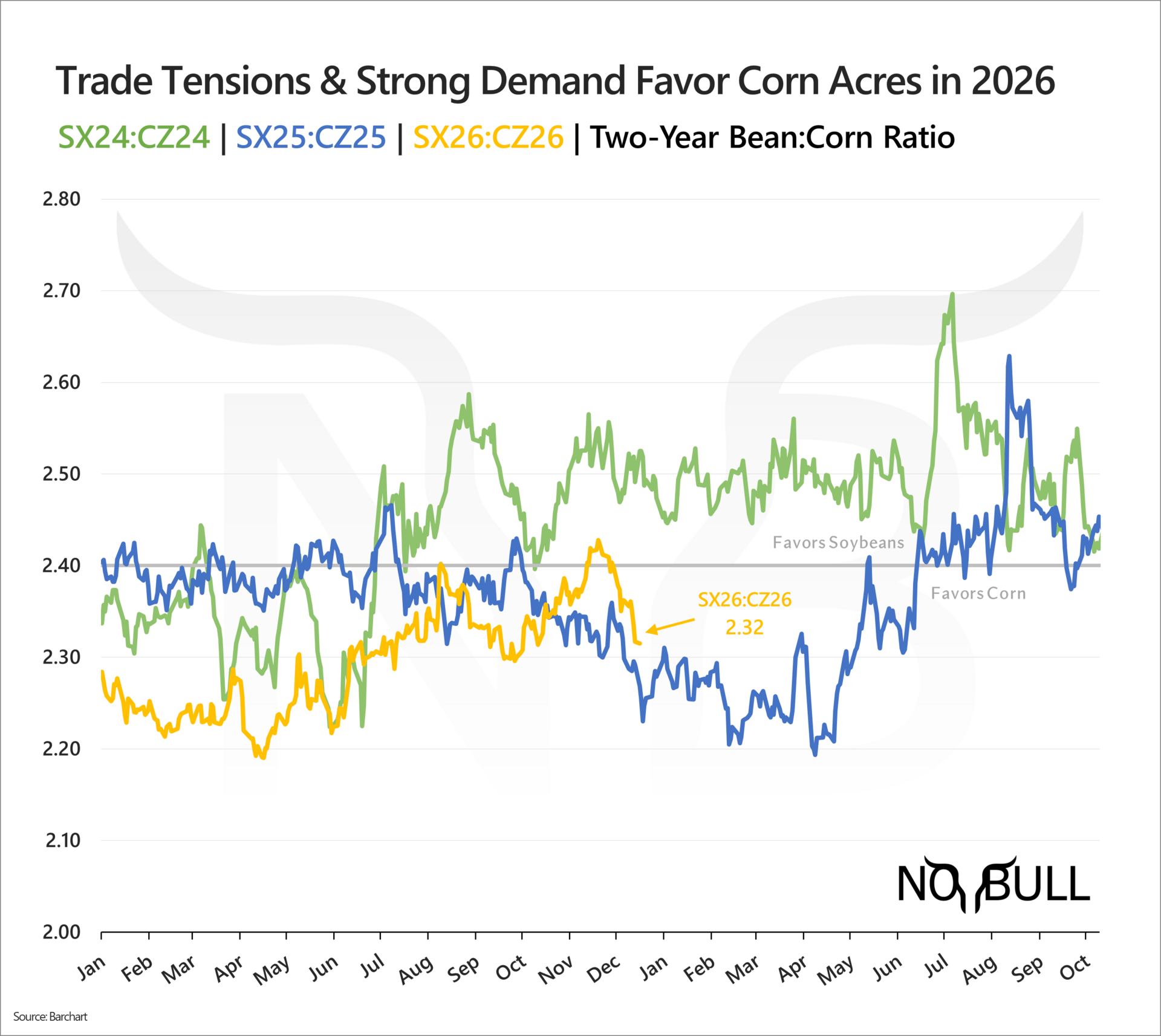

The continued weakness in soybeans and resilience in corn has pushed the 2026 bean-corn ratio to a 9-week low — reinforcing an acreage tilt toward corn for the second year in a row.

New Crop Acres: Where do we go from here?

Keep reading with 14-days free trial

Subscribe to No Bull to keep reading this post and get 14 days of free access to the full post archives.

Start trial