Week In Review

What’s that green stuff?

After a brutal few weeks to close out the year, markets finally managed to find their footing… sort of… in the week ending January 9.

March soybeans finished the week up 17 cents, their largest one-week gain since the mid-October thaw in U.S.–China relations.

Not exactly impressive — but after weeks of steady erosion, anything beats another leg lower and a fresh test of $10.

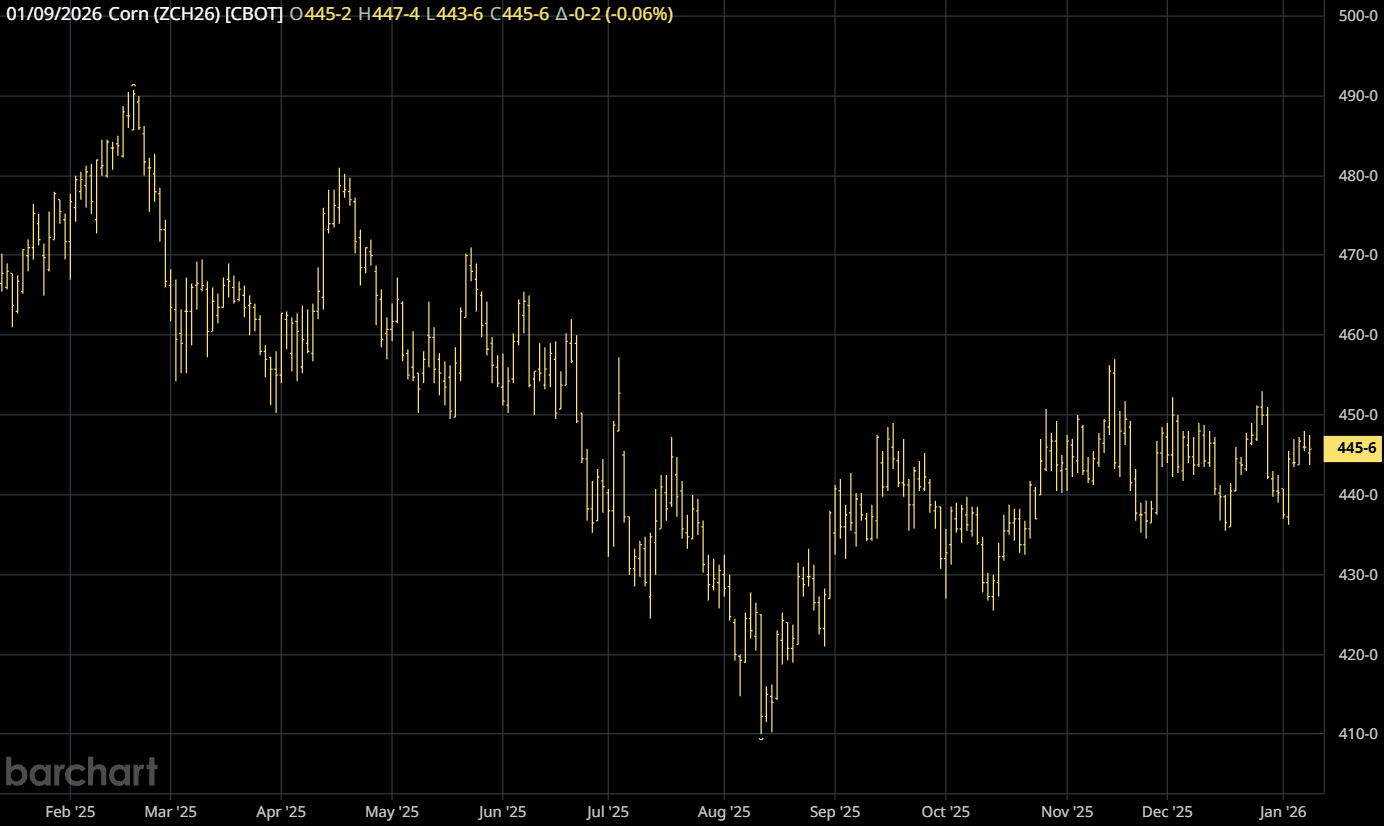

To sum up corn in one word: Stuck. Because that’s exactly what this market is.

For all the demand-driven positivity surrounding corn, it’s remarkable how little price follow-through we’ve seen.

After rebounding from the low-$4s following August’s near-189 bpa yield shock — paired with yet another acreage surprise — the market has gone nowhere, largely bouncing around between $4.40 and $4.50 in the months since.

Without clear direction ahead of January’s final production numbers - corn has been left to drift lower with beans, especially as traders take to the sidelines, unsure of what Monday’s yield print will bring.

Keep reading with 14-days free trial

Subscribe to No Bull to keep reading this post and get 14 days of free access to the full post archives.

Start trial