Week In Review

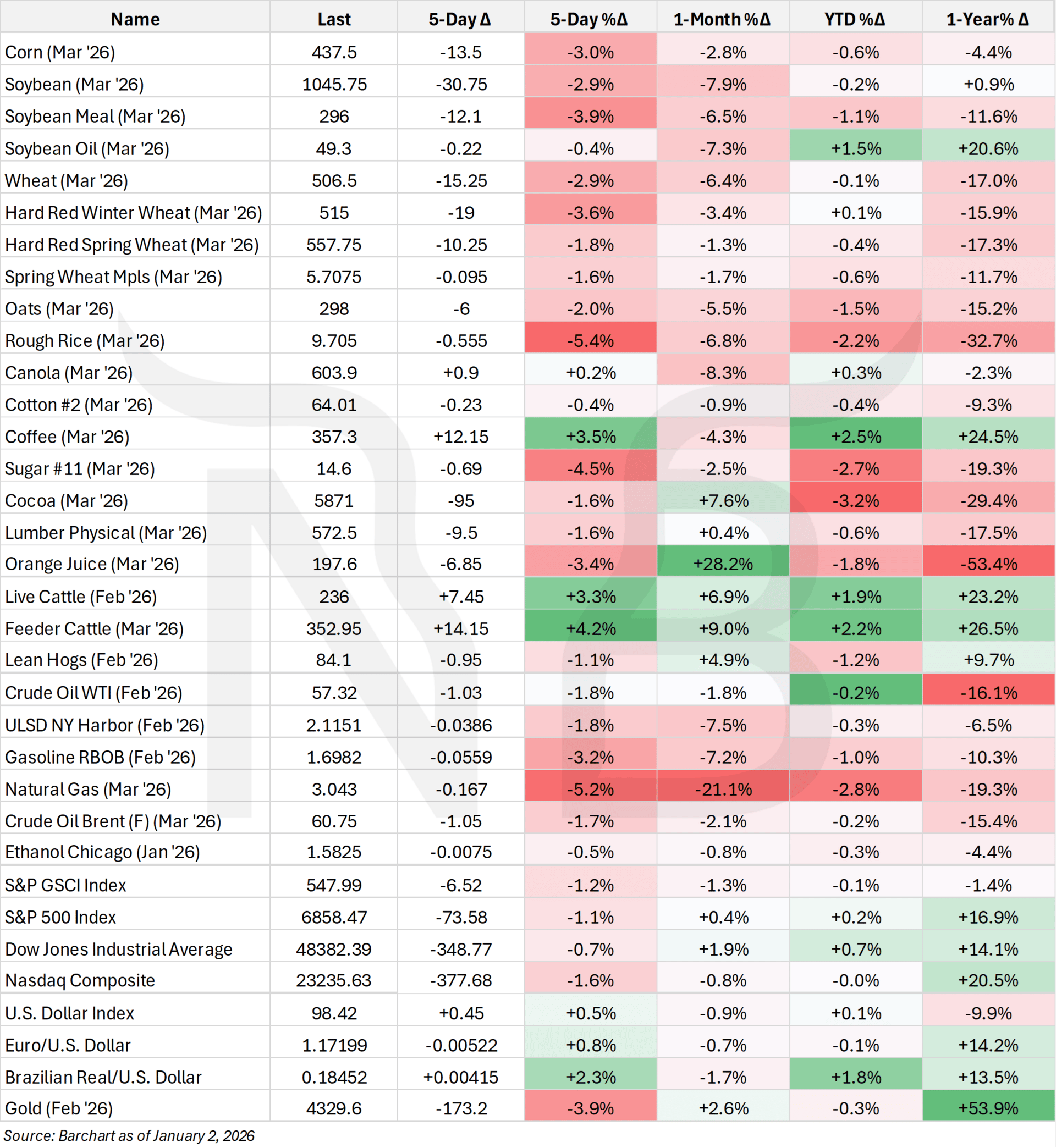

It’s been a rough few of weeks for ag commodities. Near-ideal Brazilian weather, lingering uncertainty around Chinese demand, and a sloppy slide into the new year have kept markets on the path of least resistance — lower, for now.

Soybeans have fully retraced the $1.50 rally sparked by the mid-Oct thaw in U.S.–China relations, giving back the entire move from their mid-Nov highs.

Additionally, the lack of a final rule for 2026 biofuel policy and uncertainty ahead of the January 12 stocks, crop production, WASDE, and winter wheat seedings report has left the market under pressure.

Rather than rehashing what’s already been beaten to death, this update is about perspective.

We’ll start with where new-crop futures begin the year, then step back to look at other markets that matter and what they’re telling us about where we are headed in 2026.

Beyond South America, China, and biofuel policy, two forces will shape trade in the weeks ahead: the January report and 2026 acreage decisions.

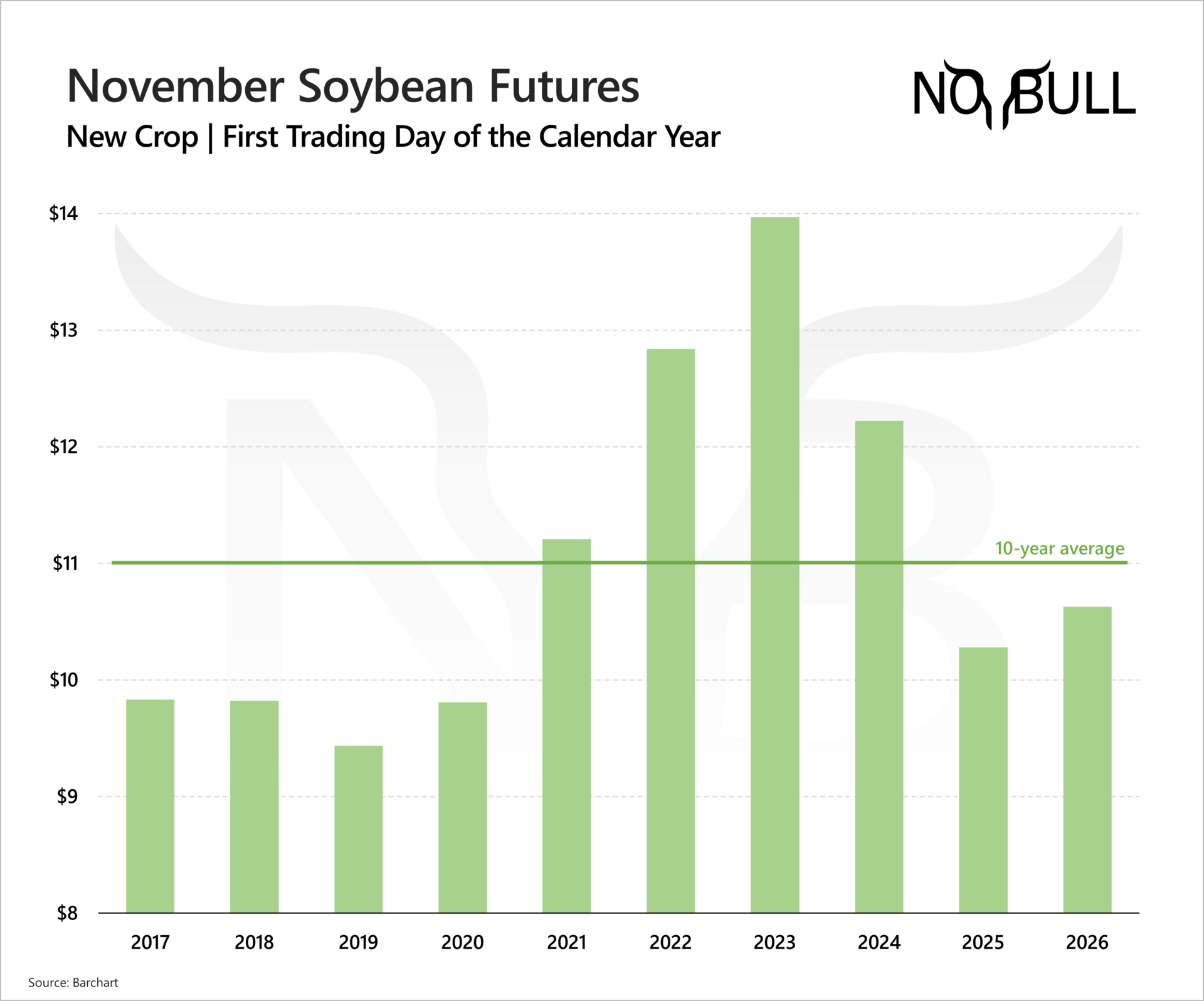

November soybean futures opened 2026 near $10.63, up roughly 3% from where SX25 started last year, but still about 3% below the 10-year average for the first trading day of the calendar year.

While new-crop futures remain a far cry from the highs of 2022–23 and early 2024, November beans have proven more resilient than headlines suggest — closing above $10 on all but 12 trading days since the fall of 2020.

Keep reading with 14-days free trial

Subscribe to No Bull to keep reading this post and get 14 days of free access to the full post archives.

Start trial