One month down, eleven to go.

Hard to believe January is already in the books, but relatively speaking it was a good one for commodities, with most markets rebounding from December’s lows.

Energy was the clear winner. Extreme winter weather drove natural gas prices sharply higher while also disrupting refinery operations, and a weaker U.S. dollar provided additional macro support. That strength spilled across the broader energy complex and set the tone for ag markets tied most closely to energy.

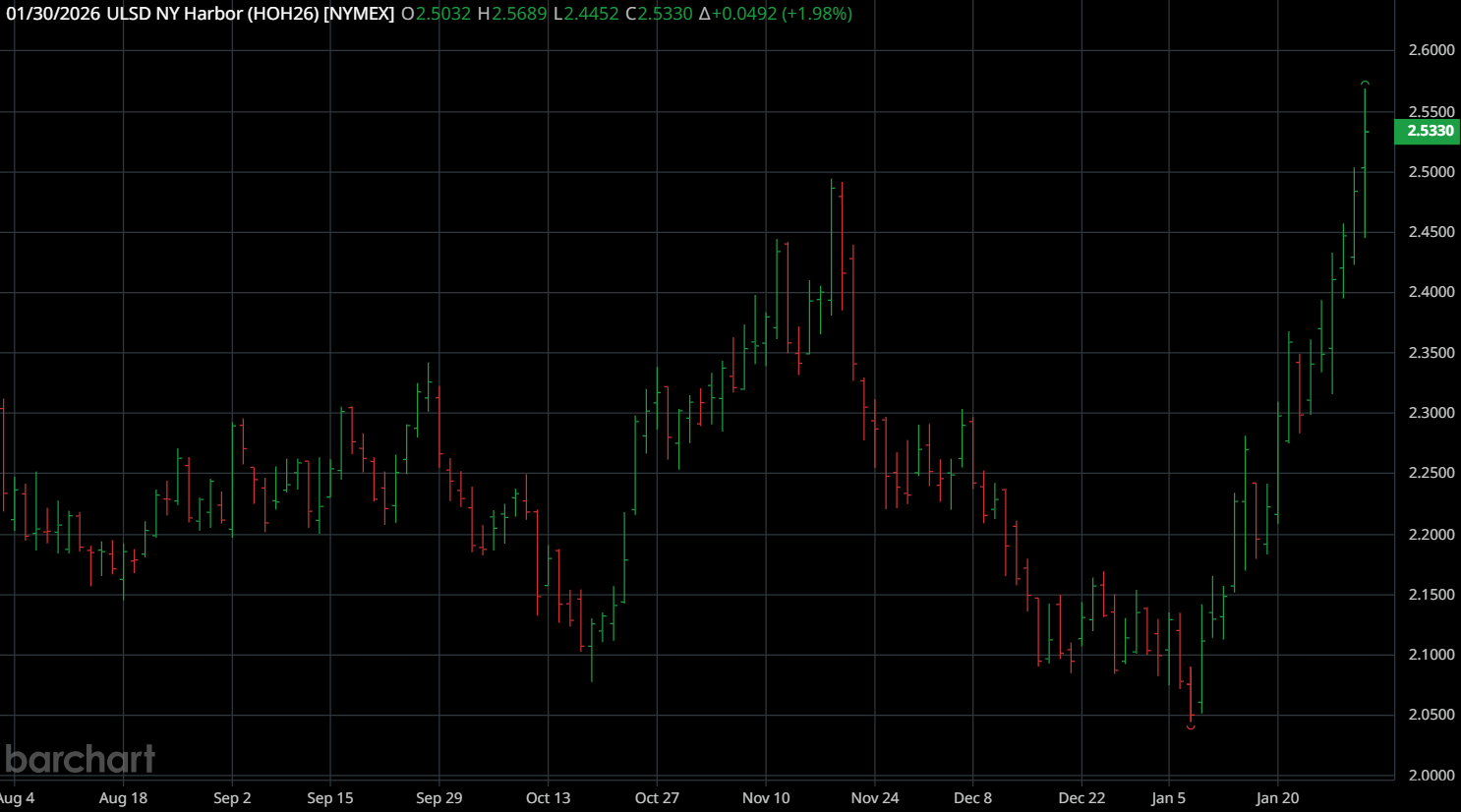

Diesel futures closed higher all but five days in January, advancing an incredibly 20.4% during that time (43c).

Soybean oil was the primary beneficiary. The energy-led rally, combined with mounting anticipation of an EPA RVO decision, pushed soybean oil up 10.2% on the month.

Oilshare gained 3% on the month. lending support to soybeans despite mixed fundamentals elsewhere in the complex.

Keep reading with 14-days free trial

Subscribe to No Bull to keep reading this post and get 14 days of free access to the full post archives.

Start trial