Ten Visuals That Defined 2025

Note: If you are a paying Pro (formerly Substack) subscriber and have difficulty viewing updates in full, please reply to this message.

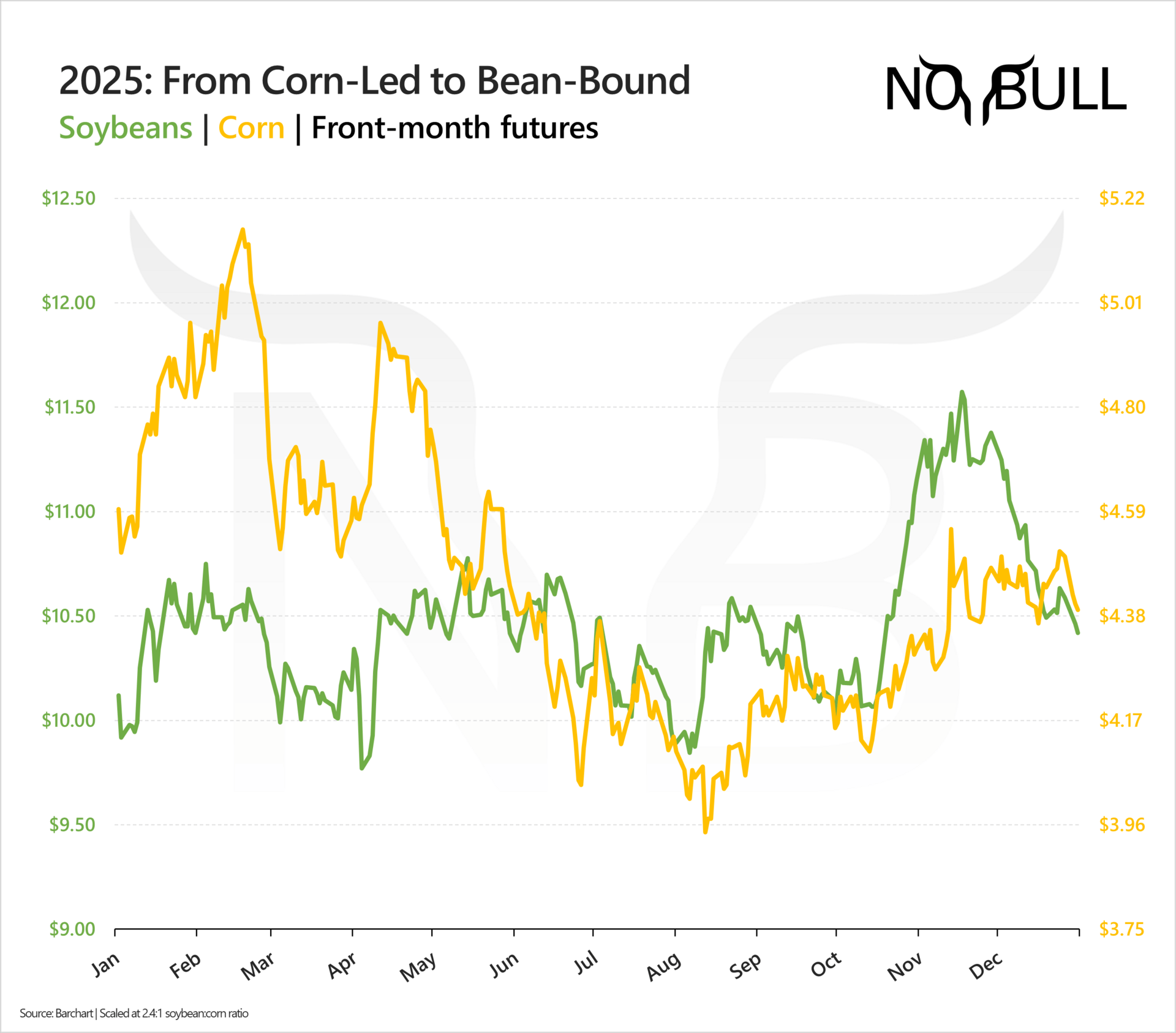

1 | Follow the Leader

Corn led early in 2025 with a strong demand story, while soybeans fought demand headwinds from day one as newly elected President Trump put China — the U.S.’s largest soybean customer — directly in his crosshairs.

Both markets broke in late February as the U.S. launched trade wars not just with China, but across the globe — including, somehow, islands inhabited only by penguins.

Corn caught a bid again in early April, even after the March 31 acreage shock, on strong old-crop demand. But big acres, big yield prospects, and an August acreage surprise eventually pushed corn briefly below $4 for the first time since September 2024.

Soybeans didn’t get their 2025 moment until the late-October deal, rallying futures more than $1 off the lows — only to run into familiar problems: weak follow-through demand and mounting pressure from yet another record Brazilian crop on the way.

Strong demand continues to keep corn afloat, but it now has a bean problem — one that’s dragging the complex lower into year-end.

2 | When Trump Speaks, Soybeans Listen

In 2025, the soybean market was driven by both Trump’s actions and statements, with futures repeatedly reacting to Truth Social posts and key media comments.

A few well-placed words were often enough to move prices — a pattern that held through the first eleven months of the year.

Trump’s last soybean-related Truth Social post came on November 24, shortly after futures hit 17-month highs on optimism around China’s return.

Keep reading with 14-days free trial

Subscribe to No Bull to keep reading this post and get 14 days of free access to the full post archives.

Start trial