For a printable one-page recap, CLICK HERE.

Corn

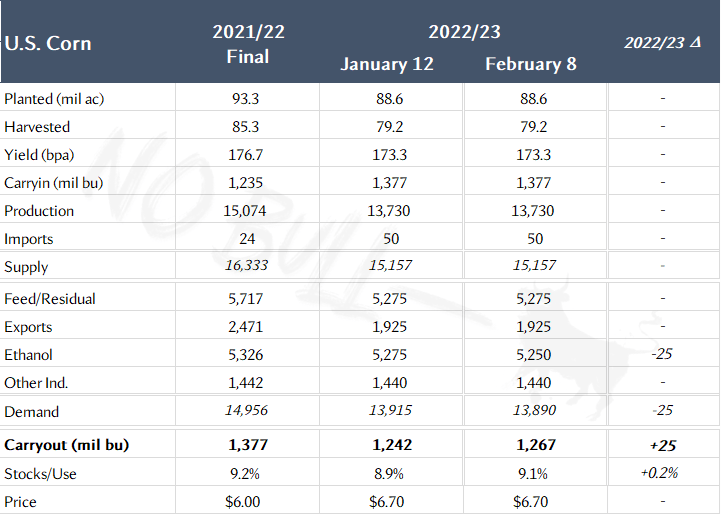

Only one change to US tables - ethanol was reduced 25mbu, raising ending stocks to 1,267 - in line with trade estimates

Argentina’s corn production was reduced more than expectations (down 5mmt at 47.0 vs an avg guess at 48.5)

Argy’s corn exports were reduced 4mmt as a result

No change to Brazilian production, but exports were raised 2.5mmt noting strong January shipments and expectations for larger volumes in the coming months

EU imports were raised 2mmt, citing increased imports from both Brazil and Ukraine

Soybeans

US crush was reduced 15 million bushels, adding the same back to ending stocks. The market wasn’t necessarily looking for a reduction in crush today, but the change wasn’t unexpected given our recent stretch of poor crush rates

The market sold off initially but has since recovered

Ending stocks now sit at 225mbu, up from 210 in Jan

No change to Brazil’s bean production, but exports were raised 1mmt citing higher Argy demand and lower competition

Argentina’s production was reduced to 41.0mmt vs a 42.3 avg guess and 45.5 in Jan. USDA’s new estimate is the same as BAGE’s 41 but remains above the Ag Attache at 36.0

Both Argy bean and meal exports were reduced, while imports were raised in kind

Wheat

US balance sheet changes are so minimal on wheat, it isn’t worth making a table

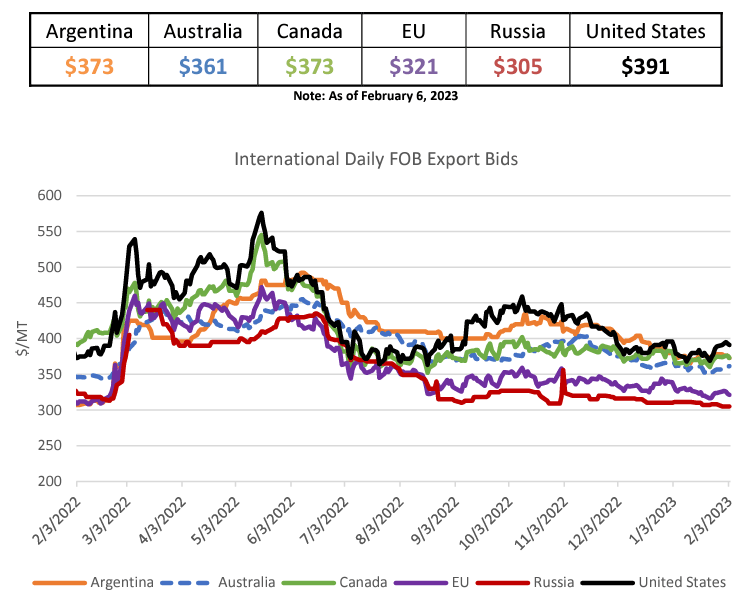

The fact remains the US is still the most expensive wheat in the world (below) which has proved prohibitive in sustaining any sort of rally

USDA did raise the Aussie crop to 38mmt (vs 36.6 in Jan) and finally raised Russia’s known bin-buster to a record 92mmt (vs sticking with 91 for 5 straight months)

More on today’s numbers in tomorrow’s No Bull.

Thanks!