Welcome to Insights — exclusively for Pro+ subscribers.

Dollar Down, Commodities Up

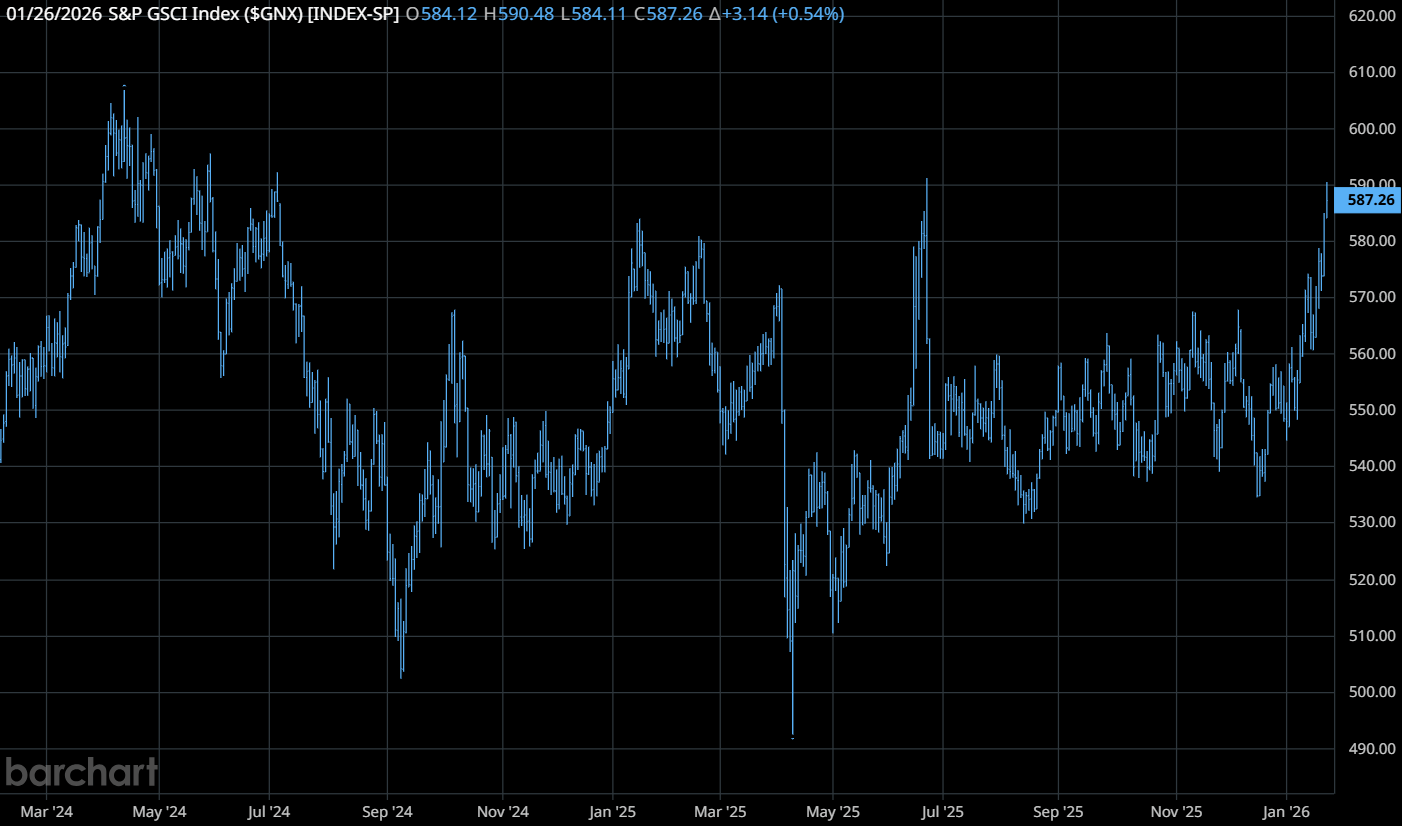

The classic inverse relationship returns, but the $GNX engine runs on different fuel in 2026

The S&P GSCI Commodity Index ($GNX) pushed above 590 today for the first time since June 2025, sitting near its highest level since July 2024.

The move caps a sharp 7.1% year-to-date rally, with more than 7% of that gain coming in less than three weeks.

At the same time, the U.S. Dollar Index ($DXY) continues to slide—down 0.5% today for a third straight session and dipping below 97 for the first time since mid-September.

The dollar is now down 2.3% on the week and 9.6% year over year, pressured by Fed rate-cut expectations and growing fiscal strain.

Historically, commodities and the dollar moved inversely—stronger dollar, weaker commodities—as dollar strength raised prices for foreign buyers and capped global demand.

That inverse relationship was the rule, not the exception.

This content is exclusive for Pro+ subscribers

Upgrade to the Pro+ Research Suite for exclusive access to Quick Hits, Insights, and The Quarterly.

Get Pro+